Good, Great, and Gruesome Businesses

Published on Jan 20, 2024 by Mihir Thakkar

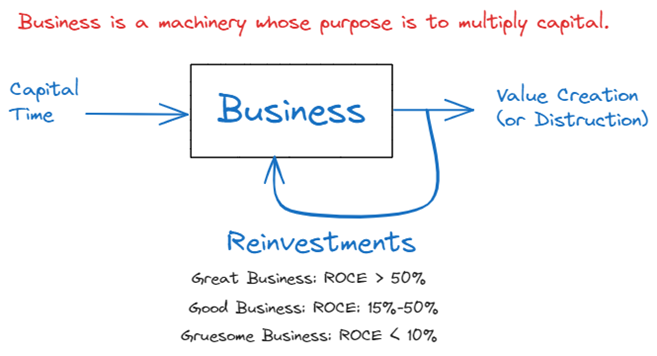

Any device, system or process can be abstracted solely in terms of its inputs and outputs, without any comprehension of its internal mechanisms – In systems theory, we call this the black box model. This analogy, when transposed to our businesses, provides an intriguing framework. Often, we as founders are so much caught into the details of our businesses that we often loose the sight of the bigger picture. This model offers a strategic lens, emphasizing capital inputs and the resultant value outputs, while abstracting the intricate operational processes therein.

We pour in capital, talent, and ideas, and out emerges a product, a service, or, in fortunate circumstances, a revolution.

The external observer doesn't see the myriad decisions, the late nights, or the serendipitous moments of insight that occur inside. They only witness the inputs and the resultant outputs.

The Varieties of These Black Boxes: Good, Great, and Gruesome

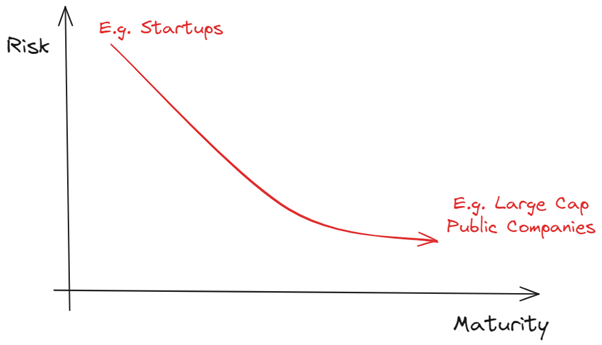

All businesses are unique, but they can be broadly categorized based on their efficiency and output. Some consistently produce value, while others seem to consume resources without delivering proportional returns.

In his 2007 Annual Letter to Berkshire Hathaway shareholders, Warren Buffett says, “Think of three types of savings accounts:

- The Great one pays an extraordinarily high interest rate that will rise as the years pass.

- The Good one pays an attractive rate of interest that will be earned also on deposits that are added.

- Finally, the Gruesome account both pays an inadequate interest rate and requires you to keep adding money at those disappointing returns.

1. Good Businesses

At first glance, a good business might seem like the ideal black box. You input resources, and it consistently produces a decent output. These businesses achieve a return on equity (ROE) greater than their cost of capital. They have found a sustainable niche, and their operations, while not extraordinary, are solid and dependable. However, while they generate value, they might lack the dynamism or potential for exponential growth. Their black box works, but can be disrupted by competition or changes in tech landscape.

2. Great Businesses

The Great businesses are the marvels of the business world. They are black boxes that not only produce impressive outputs but seem to do so with increasing efficiency and scale. These businesses don't just achieve a high ROE; they have the ability to reinvest their earnings at similarly high rates, leading to compounding growth. What sets them apart is a durable competitive advantage, often termed a "moat," which allows them to fend off competitors and consistently deliver exceptional results. Investing in understanding and optimizing the inner workings of such a black box can yield exponential rewards.

3. Gruesome Businesses

On the other end of the spectrum, we have the Gruesome businesses. These are black boxes that seem to drain more than they produce. Despite consuming resources, talent, and capital, their returns often fall below their cost of capital. They may operate in highly competitive sectors, face structural challenges, or suffer from inefficient operations. The inner mechanics of these black boxes are fraught with inefficiencies, and they often erode value over time.

In our black box analogy, these categories help us understand the efficiency, potential, and challenges of the internal processes. While the external observer sees only the inputs and outputs, understanding whether a business is Good, Great, or Gruesome offers profound insights into its internal dynamics. As we navigate the business landscape, recognizing the nature of these black boxes can guide strategic decisions, investments, and growth trajectories.

Evolution Through Phases